CIFC Exam Dumps - Canadian Investment Funds Course Exam

Searching for workable clues to ace the IFSE Institute CIFC Exam? You’re on the right place! ExamCert has realistic, trusted and authentic exam prep tools to help you achieve your desired credential. ExamCert’s CIFC PDF Study Guide, Testing Engine and Exam Dumps follow a reliable exam preparation strategy, providing you the most relevant and updated study material that is crafted in an easy to learn format of questions and answers. ExamCert’s study tools aim at simplifying all complex and confusing concepts of the exam and introduce you to the real exam scenario and practice it with the help of its testing engine and real exam dumps

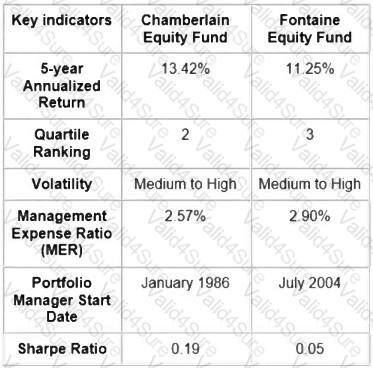

You have been researching Canadian equity mutual funds for a new client. You come across the following information.

What can you conclude from this information?

Which of the following statements about capital gains distributions from mutual fund trusts is correct?

With respect to the tax treatment of dividends received from a taxable Canadian corporation, which of the following statements is CORRECT?

Hamid, the portfolio manager of the Trabant Canadian Equity Fund is deciding on some new investments. He has identified a retirement residence company as well as a discount clothing retailer that both seem to have good prospects and appear undervalued. What investment approach is Hamid using?

Nelson is a Dealing Representative with True Wealth Advisors Inc., a mutual fund dealer. Nelson follows proper procedures related to his firm’s Relationship Disclosure Information (RDI). Which of the following CORRECTLY describes how Nelson is permitted to evidence that he satisfied his RDI obligation?

What is the national self-regulatory organization (SRO) for investment dealers?

Patrick is a portfolio manager for the HyperTally Growth Fund. It has generated an annualized rate of return of 10% this past year. However, with the anticipation of very high inflation to soon occur, there is also an expectation of higher interest rates. Patrick is concerned about the future returns of existing stocks within the fund. What may Patrick do to protect against the market value of the fund dropping?

The following table shows Sabrina's earned income for the past few years:

Sabrina has always maximized her RRSP contributions, so she has no carry-forward room available. If the maximum contribution limit for Year 3 is $24,270, what is her RRSP contribution room for Year 3?