MB-310 Exam Dumps - Microsoft Dynamics 365 Finance

Searching for workable clues to ace the Microsoft MB-310 Exam? You’re on the right place! ExamCert has realistic, trusted and authentic exam prep tools to help you achieve your desired credential. ExamCert’s MB-310 PDF Study Guide, Testing Engine and Exam Dumps follow a reliable exam preparation strategy, providing you the most relevant and updated study material that is crafted in an easy to learn format of questions and answers. ExamCert’s study tools aim at simplifying all complex and confusing concepts of the exam and introduce you to the real exam scenario and practice it with the help of its testing engine and real exam dumps

A company has implemented Dynamics 365 Finance.

The company pays taxes quarterly to the states of Florida, Nebraska, and Washington. These states have been set up as tax authorities within Dynamics 365 Finance.

You need to configure the system to remit tax payments.

What should you do?

A company is implementing Microsoft Dynamics 365 Finance.

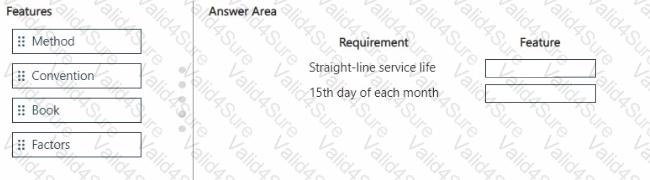

The company is configuring depreciation for company vehicles. Vehicles must be depreciated by using straight-line service life on the 15th day of each month.

You need to configure vehicle depreciation.

What should you use? To answer, drag the appropriate features to the correct requirements. Each feature may be used once, more than once, or not at all. You may need to drag the split bar between panes or scroll to view content.

NOTE: Each correct selection is worth one point.

A company uses Microsoft Dynamics 365 Finance.

You need to reclassify a fixed asset.

Which three actions does the system perform when an asset is reclassified? Each correct answer presents part of the solution.

NOTE: Each correct selection is worth one point

You are configuring budgeting components in Dynamics 365 for Finance and Operations.

You need to configure multiple budgets.

What are three budgeting options you can use? Each correct answer presents a complete solution.

NOTE: Each correct selection is worth one point.

Users are posting project transactions and bank transactions incorrectly in the General journal. The client wants to prevent this from happening in the future

You need to configure Dynamics 365 for Finance and Operations to limit the account type transactions to only ledger.

What should you do?