8006 Exam Dumps - Exam I: Finance Theory Financial Instruments Financial Markets - 2015 Edition

Searching for workable clues to ace the PRMIA 8006 Exam? You’re on the right place! ExamCert has realistic, trusted and authentic exam prep tools to help you achieve your desired credential. ExamCert’s 8006 PDF Study Guide, Testing Engine and Exam Dumps follow a reliable exam preparation strategy, providing you the most relevant and updated study material that is crafted in an easy to learn format of questions and answers. ExamCert’s study tools aim at simplifying all complex and confusing concepts of the exam and introduce you to the real exam scenario and practice it with the help of its testing engine and real exam dumps

Which of the following statements is not true about covered calls on stocks

An investor enters into a 4 year interest rate swap with a bank, agreeing to pay a fixed rate of 4% on a notional of $100m in return for receiving LIBOR. What is the value of the swap to the investor two years hence, immediately after the net interest payments are exchanged? Assume the current zero coupon bond yields for 1, 2 and 3 years are 5%, 6% and 7% respectively. Also assume that the yield curve stays the same after two years (ie, at the end of year two, the rates for the following three years are 5%, 6%, and 7% respectively).

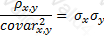

The relationship between covariance and correlation for two assets x and y is expressed by which of the following equations (where covarx,y is the covariance between x and y, σx and σy are the respective standard deviations and Ïx,y is the correlation between x and y):

A)

B)

C)

D)

None of the above

What is the price of a treasury bill with $100 face maturing in 90 days and yielding 5%?

A fund manager buys a gold futures contract at $1000 per troy ounce, each contract being worth 100 ounces of gold. Initial margin is $5,000 per contract, and the exchange requires a maintenance margin to be maintained at $4,000 per contract. Prices fall the next day to $980. What is the margin call the fund manager faces in respect of daily variation margin ?