CCRA-L2 Exam Dumps - Certified Credit Research Analyst Level 2

Satish Dhawan, a veteran fixed income trader is conducting interviews for the post of a junior fixed income trader. He interviewed four candidates Adam, Balkrishnan, Catherine and Deepak and following are the answers to his questions.

Question 1: Tell something about Option Adjusted Spread

Adam: OAS is applicable only to bond which do not have any options attached to it. It is for the plain bonds.

Balkishna: In bonds with embedded options, AS reflects not only the credit risk but also reflects prepayment

risk over and above the benchmark.

Catherine: Sincespreads are calculated to know the level of credit risk in the bound, OAS is difference between in the Z spread and price of a call option for a callable bond.

Deepark: For callable bond OAS will be lower than Z Spread.

Question 2: This is a spread that must be added to the benchmark zero rate curve in a parallel shift so that the sum of the risky bond’s discounted cash flows equals its current market price. Which Spread I am talking about?

Adam: Z Spread

Balkrishna: Nominal Spread

Catherine: Option Adjusted Spread

Deepark: Asset Swap Spread

Question 3: What do you know about Interpolated spread and yield spread?

Adam: Yield spread is the difference between the YTM of a risky bond and the YTM of an on-the-run treasury benchmark bond whose maturity is closest, but not identical to that of risky bond. Interpolated spread is the spread between the YTM of risky bond and the YTM of same maturity treasury benchmark, which is interpolated from the two nearest on-the-run treasury securities.

Balkrishna: Interpolated spread is preferred to yield spread because the latter has the maturity mismatch, which leads to error if the yield curve is not flat and the benchmark security changes over time, leading to inconsistency.

Catherine: Interpolated spread takes account the shape of the benchmark yield curve and therefore better than yield spread.

Deepak: Both Interpolated Spread and Yield Spread rely on YTM which suffers from drawbacks and inconsistencies such as the assumption of flat yield curve and reinvestment at YTM itself.

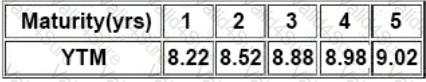

Then Satish gave following information related to the benchmark YTMs:

There is an 8.75% risky bond with a maturity of 2.75% year(s). Its current price is INR102.31, which corresponds to YTM of 8.52%. Compute Yield Spread from the information provided in the vignette:

Satish Dhawan, a veteran fixed income trader is conducting interviews for the post of a junior fixed income trader. He interviewed four candidates Adam, Balkrishnan, Catherine and Deepak and following are the answers to his questions.

Question 1: Tell something about Option Adjusted Spread

Adam: OAS is applicable only to bond which do not have any options attached to it. It is for the plain bonds.

Balkishna: In bonds with embedded options, AS reflects not only the credit risk but also reflects prepayment risk over and above the benchmark.

Catherine: Sincespreads are calculated to know the level of credit risk in the bound, OAS is difference between in the Z spread and price of a call option for a callable bond.

Deepark: For callable bond OAS will be lower than Z Spread.

Question 2: This is a spread that must be added to the benchmark zero rate curve in a parallel shift so that the sum of the risky bond’s discounted cash flows equals its current market price. Which Spread I am talking about?

Adam: Z Spread

Balkrishna: Nominal Spread

Catherine: Option Adjusted Spread

Deepark: Asset Swap Spread

Question 3: What do you know about Interpolated spread and yield spread?

Adam: Yield spread is the difference between the YTM of a risky bond and the YTM of an on-the-run treasury benchmark bond whose maturity is closest, but not identical to that of risky bond. Interpolated spread is the spread between the YTM of risky bond and the YTM of same maturity treasury benchmark, which is interpolated from the two nearest on-the-run treasury securities.

Balkrishna: Interpolated spread is preferred to yield spread because the latter has the maturity mismatch, which leads to error if the yield curve is not flat and the benchmark security changes over time, leading to inconsistency.

Catherine: Interpolated spread takes account the shape of the benchmark yield curve and therefore better than yield spread.

Deepak: Both Interpolated Spread and Yield Spread rely on YTM which suffers from drawbacks and inconsistencies such as the assumption of flat yield curve and reinvestment at YTM itself.

Then Satish gave following information related to the benchmark YTMs:

Who amongst the four candidates is correct regarding OAS?