- Home

- CIPS

- CIPS Level 6 Professional Diploma in Procurement and Supply

- L6M2 - Global Commercial Strategy

L6M2 Exam Dumps - Global Commercial Strategy

Evaluate diversification as a growth strategy. What are the main drivers and risks?

Answer:

Explanation:

Evaluation of Diversification as a Growth Strategy

Introduction

Diversification is agrowth strategywhere a company expands intonew markets or develops new productsthat are different from its existing offerings. It is theriskiest strategyinAnsoff’s Growth Matrix, but it can provide significant opportunities forbusiness expansion, revenue diversification, and risk mitigation.

Diversification is driven by factors such asmarket saturation, competitive pressure, and technological advancementsbut also carries risks related tohigh investment costs and operational complexity.

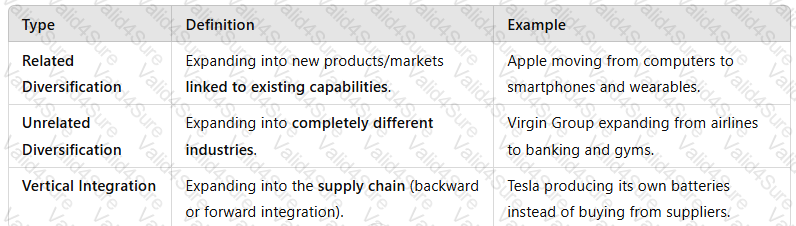

1. Types of Diversification

A screenshot of a computer

Description automatically generated

A screenshot of a computer

Description automatically generated

2. Main Drivers of Diversification🚀

1. Market Saturation and Competitive Pressure

When a businessreaches peak growthin its existing market, diversification helpsfind new revenue streams.

Competition forces businessesto explore new industries for continued growth.

💡Example:Amazonexpanded from anonline bookstore to cloud computing (AWS)due to competition and limited retail growth.

2. Risk Reduction and Business Sustainability

Diversifying reducesdependence on a single market or product.

Protects the business againsteconomic downturns and industry-specific risks.

💡Example:Samsung operates in electronics, shipbuilding, and insurance, reducing reliance on one sector.

3. Leveraging Core Competencies and Brand Strength

Companies useexisting expertise, technology, or brand reputationto enter new markets.

💡Example:Nike expanded from sportswear to fitness apps and wearable technology.

4. Technological Advancements & Market Opportunities

Digital transformation and innovationcreate opportunities for diversification.

Companies invest innew technologies, AI, and automationto expand their offerings.

💡Example:Google diversified into AI, smart home devices, and autonomous vehicles (Waymo).

3. Risks of Diversificationâš ï¸

1. High Investment Costs & Uncertain Returns

Diversification requiressignificant R&D, marketing, and infrastructure investment.

ROI is uncertain, andfailure can result in financial losses.

💡Example:Coca-Cola's failed diversification into the wine industryresulted in losses due to brand mismatch.

2. Lack of Expertise & Operational Challenges

Expanding intounfamiliar industriesincreasesoperational complexity and risks.

Companies maylack the expertiserequired for success.

💡Example:Tesco’s expansion into the US market (Fresh & Easy) faileddue to a lack of understanding of American consumer behavior.

3. Dilution of Brand Identity

Expanding into unrelated sectors canconfuse customersandweaken brand strength.

💡Example:Harley-Davidson’s attempt to enter the perfume marketdamaged its brand credibility.

4. Regulatory and Legal Barriers

Compliance with different industry regulationscan be complex and costly.

💡Example:Facebook faced regulatory scrutinywhen diversifying into financial services withLibra cryptocurrency.

4. Conclusion

Diversification can be ahigh-reward growth strategy, but it requires carefulplanning, market research, and strategic alignment.

✅Main driversincludemarket saturation, risk reduction, leveraging expertise, and technology opportunities.âŒKey risksincludehigh costs, operational challenges, brand dilution, and regulatory barriers.

Companies mustevaluate diversification carefullyand ensurestrategic fit, financial feasibility, and market demandbefore expanding into new industries.

Discuss the difference between a merger and an acquisition. What are the main drivers and risks associated with this approach to growth compared to an organic development strategy?

Answer:

Explanation:

Mergers vs. Acquisitions: Drivers, Risks, and Comparison to Organic Growth

Introduction

Businesses seeking growth can expand throughmergers and acquisitions (M&A)or byorganic development. Mergers and acquisitions involveexternal growth strategies, where companies combine forces or take over another business, whereas organic growth occursinternally through investment in operations, R&D, and market expansion.

While M&A strategies providerapid expansion and competitive advantages, they also carryintegration risks and financial complexitiescompared to organic growth.

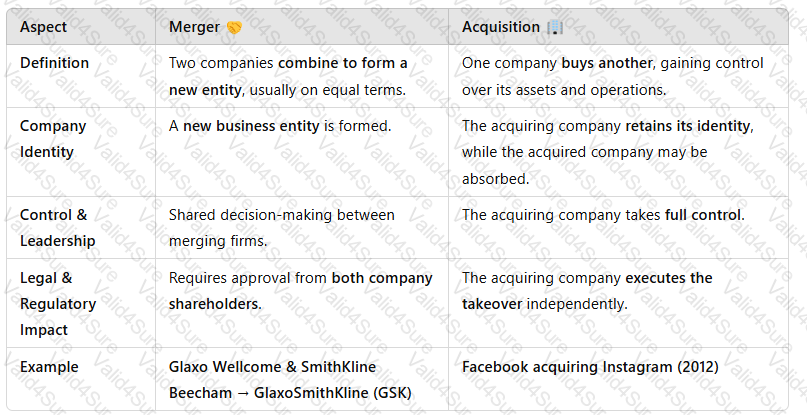

1. Difference Between a Merger and an Acquisition

A screenshot of a computer

Description automatically generated

A screenshot of a computer

Description automatically generated

Key Takeaway:Mergers are usuallycollaborative, while acquisitions involveone company dominating another.

2. Main Drivers of Mergers & Acquisitions (M&A)🚀

1. Market Expansion & Faster Growth

✅Providesimmediate accessto new markets, customers, and geographies.✅Faster than organic growth, allowing firms toscale operations quickly.

💡Example:Amazon’s acquisition of Whole Foodsgave it an instant presence in the grocerysector.

2. Cost Synergies & Efficiency Gains

✅Reducesduplication of functions(e.g., shared IT, supply chain).✅Achieveseconomies of scale, lowering operating costs.

💡Example:Disney’s acquisition of 21st Century Foxreduced production costs by consolidating media assets.

3. Competitive Advantage & Market Power

✅Eliminates competition by absorbingrival firms.✅Strengthensbargaining power over suppliers and distributors.

💡Example:Google acquiring YouTuberemoved a major competitor in the video-sharing industry.

4. Access to New Technology & Innovation

✅Fast-tracksadoption of emerging technologies.✅Avoids lengthyin-house R&D developmentcycles.

💡Example:Microsoft’s acquisition of LinkedIngave it access to AI-driven professional networking tools.

3. Risks of Mergers & Acquisitionsâš ï¸

1. Cultural & Operational Integration Challenges

âŒEmployees from different companies mayresist integration, leading to conflicts.âŒDifferent corporate culturesmay result in productivity loss.

💡Example:TheDaimler-Chrysler merger faileddue to cultural clashes between German and American management styles.

2. High Financial Costs & Debt Risks

âŒAcquiring companiesoften take on large amounts of debt.âŒM&A dealsmay overvalue the target company, leading to losses.

💡Example:AOL’s acquisition of Time Warner($165 billion) resulted inhuge financial lossesdue to overvaluation.

3. Regulatory and Legal Barriers

âŒGovernment regulators mayblock mergers due to monopoly concerns.âŒLegal challenges maydelay or cancel deals.

💡Example:TheEU blocked Siemens and Alstom’s rail mergerdue to competition concerns.

4. Disruption to Core Business

âŒManagement focus on M&A candistract from existing operations.âŒPost-merger integration complexitiescan lead to delays and inefficiencies.

💡Example:HP’s acquisition of Compaqresulted in years of internal restructuring, impacting performance.

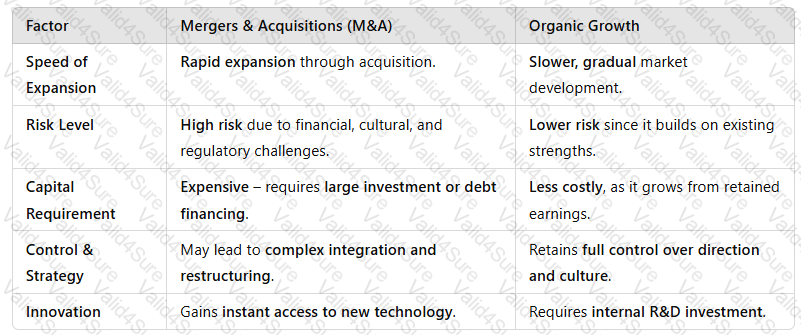

4. Comparison: M&A vs. Organic Growth

A screenshot of a computer

Description automatically generated

A screenshot of a computer

Description automatically generated

Key Takeaway:M&A providesfast expansionbut comes withhigher risks, whereas organic growth isslower but more sustainable.

5. Conclusion

Mergers and acquisitions offera fast-track to market leadership, providinggrowth, cost synergies, and competitive advantages. However, they also carrysignificant financial, cultural, and regulatory riskscompared to organic growth.

✅Best for:Companies needingrapid expansion, technology access, or competitive positioning.âŒRisky when:Poor cultural integration, excessive debt, or regulatory obstacles arise.

Businesses mustcarefully assess strategic fit, financial feasibility, and post-merger integration plansbefore choosing M&A as a growth strategy.

XYZ is a large technology organisation which has used an aggressive growth strategy to become the market leader. It frequently buys out smaller firms to add to its increasing portfolio of businesses. How could XYZ use the Kachru Parenting Matrix to assist in decision making regarding future investments?

Answer:

Explanation:

Using the Kachru Parenting Matrix for XYZ’s Investment Decisions

Introduction

TheKachru Parenting Matrixis astrategic decision-making toolthat helps businesses evaluate how well aparent company can add value to its subsidiaries. For XYZ, alarge technology firmthat follows anaggressive acquisition strategy, the Kachru Parenting Matrix can guide investment decisions byassessing the synergy between the parent company (XYZ) and its acquired businesses.

By using this matrix, XYZ can determine which acquisitions willbenefit from its expertise, resources, and management style, ensuring maximum strategic alignment and value creation.

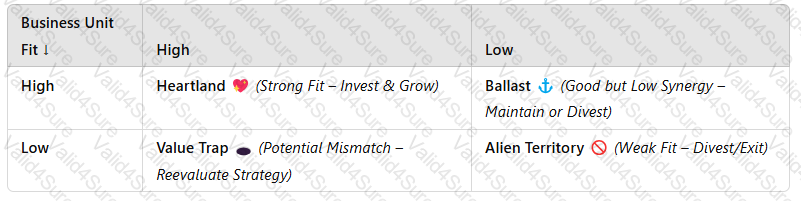

1. Explanation of the Kachru Parenting Matrix

TheKachru Parenting Matrixevaluates business units based on:

Business Unit Fit– How well the subsidiary aligns with the parent company’score capabilities and expertise.

Parenting Advantage– The ability of the parent company toadd valueto the subsidiary through strategic oversight, resources, and expertise.

It categorizes business units intofour quadrants, influencing investment decisions:

|Parenting Advantage →

A screenshot of a computer

Description automatically generated

A screenshot of a computer

Description automatically generated

2. How XYZ Can Use the Kachru Parenting Matrix for Investment Decisions

1. Identifying Core Growth Areas – Heartland Businesses💖(Invest & Grow)

These businessesstrongly alignwith XYZ’s expertise and benefit from itstechnology, resources, and leadership.

XYZ shouldprioritize investment, innovation, and expansionin these areas.

💡Example:If XYZ specializes inAI and cloud computing, acquiringsmaller AI startupswould fall into theHeartlandcategory, ensuring seamless integration and value creation.

✅Strategic Action:Invest inR&D, talent acquisition, and global expansionfor these subsidiaries.

2. Maintaining Complementary Businesses – Ballast Businesses⚓(Maintain or Divest if Needed)

These businesses areprofitable but do not directly fit XYZ’s core strategy.

XYZ cankeep them for financial stabilityor sell them if theydrain management resources.

💡Example:If XYZ acquires ahardware companybut primarily operates insoftware, the hardware unit maynot fully align with its expertise.

✅Strategic Action:Maintain for profitabilityor sell if it becomes a burden.

3. Avoiding Value Draining Investments – Value Trap Businesses🕳ï¸(Reevaluate or Divest)

These businessesseem promising but struggle under XYZ’s management approach.

They may requiretoo much intervention, reducing overall profitability.

💡Example:If XYZ buysa social media companybut lacks the right expertise to monetize it effectively, itbecomes a value trap.

✅Strategic Action:Reevaluateif restructuring is possible; otherwise,sellto avoid financial losses.

4. Exiting Poorly Aligned Businesses – Alien Territory🚫(Divest Immediately)

These businessesdo not align at allwith XYZ’s strategy or expertise.

Keeping them leads toresource misallocation and inefficiencies.

💡Example:If XYZ acquiresa retail clothing company, it would be inAlien Territory, as it does not fit within thetechnology industry.

✅Strategic Action:Divest or spin offthese businesses to focus on core competencies.

3. Strategic Benefits of Using the Kachru Parenting Matrix

✅Improves Investment Focus– Helps XYZidentify the most valuable acquisitions.✅Enhances Synergy & Value Creation– Ensuressubsidiaries benefit from XYZ’s resources and leadership.✅Prevents Poor Acquisitions– Avoidswasting capital on unrelated businesses.✅Optimizes Portfolio Management– Balanceshigh-growth and stable revenue businesses.

4. Conclusion

TheKachru Parenting Matrixis acritical toolfor XYZ to assessfuture acquisitions, ensuring that each business unit contributes tolong-term profitability and strategic alignment.

✅Heartland businessesshould receivemaximum investment.✅Ballast businessescan be maintainedfor financial stability.✅Value Trap businessesshould bereevaluated or restructured.✅Alien Territory businessesmust bedivested to avoid inefficiencies.

By using this framework, XYZ can ensuresmarter, more strategic acquisitions, maintaining itsmarket leadershipwhileavoiding financial risks.

Evaluate the role of strategic human management in creating competitive advantage for an organisation

Answer:

Explanation:

Evaluation of the Role of Strategic Human Resource Management (SHRM) in Creating Competitive Advantage

Introduction

Strategic Human Resource Management (SHRM) is theproactive alignment of HR policies withbusiness strategyto achieve long-term success. It focuses on developingtalent, leadership, culture, and employee engagementto enhanceorganizational performance and competitiveness.

By implementingeffective SHRM practices, companies can create asustainable competitive advantagethrough a highly skilled and motivated workforce.

1. The Role of SHRM in Creating Competitive Advantage

1.1 Talent Acquisition and Workforce Planning

✅Why it matters?

Recruiting and retaininghighly skilled employeesis essential for innovation and efficiency.

Workforce planning ensuresthe right people are in the right rolesat the right time.

💡Example:Google’s strategic hiring approachfocuses on attractingtop AI and engineering talent, driving innovation in tech.

✅Competitive Advantage Created:✔Builds anexpert workforcethat competitors cannot easily replicate.✔Reducesturnover costsby ensuring long-term retention.

1.2 Employee Development and Training

✅Why it matters?

Continuous learning and skills development enhanceemployee productivity and innovation.

Upskilling employees keeps companies ahead infast-changing industries.

💡Example:Amazon’s Career Choice Programinvests in employee training to develop future leaders and improve workforce capabilities.

✅Competitive Advantage Created:✔Enhances organizational agilityby equipping employees withemerging skills.✔Creates a culture ofcontinuous improvement and innovation.

1.3 Performance Management and Employee Engagement

✅Why it matters?

Effective performance management systemsensure employees align with business goals.

Engaged employees aremore productive, motivated, and committedto company success.

💡Example:Salesforce’s focus on employee engagementthrough leadership development and internal career growth has resulted in high retention and innovation.

✅Competitive Advantage Created:✔Driveshigh workforce productivityand efficiency.✔Reduces costs related topoor performance and disengagement.

1.4 HR Technology and Data-Driven Decision-Making

✅Why it matters?

Digital HR tools (e.g.,AI-driven recruitment, performance analytics, HR automation) optimize talent management.

Data-driven HR strategies help predictworkforce trends and talent gaps.

💡Example:Unilever uses AI-driven HR analyticsto identify high-potential employees and enhance leadership succession planning.

✅Competitive Advantage Created:✔Enablesdata-driven workforce planningfor future growth.✔Increasesefficiency and reduces hiring biases.

1.5 Employee Well-being and Diversity & Inclusion

✅Why it matters?

Work-life balance policies, mental health support, and DEI (Diversity, Equity, Inclusion) programsimprove workplace culture.

Diverse teamsenhance creativity, problem-solving, and innovation.

💡Example:Microsoft’s Diversity & Inclusion programshave strengthened its brand and innovation by fostering amore inclusive workforce.

✅Competitive Advantage Created:✔Attractstop global talentwho seek inclusive workplaces.✔Strengthensbrand reputation and employee loyalty.

2. Advantages of Strategic HRM in Competitive Positioning

✅Develops Unique Talent & Expertise– Hard for competitors to replicate.✅Enhances Productivity & Efficiency– Skilled, engaged employees drive better results.✅Supports Business Agility & Innovation– Workforce is adaptable to market changes.✅Builds Strong Employer Brand– Attracts and retains high-quality talent.

📌Key Takeaway:SHRM transformsHR from an administrative function to a strategic assetthat creates long-term value.

3. Challenges & Risks of SHRM

âŒImplementation Costs– Advanced HR technology and training require investment.âŒResistance to Change– Employees may resist new HR policies.âŒMeasuring ROI Can Be Complex– Talent development impacts long-term but ishard to quantify.âŒLegal & Compliance Risks– Global HR policies mustalign with labor lawsacross different countries.

📌Solution:Businesses must integrateHR analytics, leadership buy-in, and cultural change strategiesto overcome these challenges.

4. Conclusion

Strategic Human Resource Management (SHRM) isa key driver of sustainable competitive advantageby:

✅Attracting and retaining top talent.✅Developing a highly skilled, engaged, and innovative workforce.✅Leveraging HR technology and data-driven insights.✅Promoting employee well-being, diversity, and inclusion.

Companies thatprioritize SHRMcreate adynamic, future-ready workforce, ensuring long-term success in competitive markets.

XYZ is a high fashion clothing designer and wishes to complete a benchmarking exercise. Discuss priority dimensions to be measured in the benchmarking exercise and propose a strategy for completing the exercise

Answer:

Explanation:

Benchmarking Exercise for XYZ – A High Fashion Clothing Designer

Introduction

Benchmarking is astrategic performance measurement toolthat helps businesses compare theirprocesses, products, and strategieswith industry leaders to identify areas for improvement.

As ahigh fashion clothing designer, XYZ must focus onkey priority dimensionssuch asproduct quality, supply chain efficiency, sustainability, brand positioning, and customer engagement. A structuredbenchmarking strategyensures that XYZ can achievecompetitive advantage, optimize operations, and align with industry best practices.

1. Priority Dimensions to be Measured in Benchmarking

XYZ should focus on the followingfive key benchmarking dimensionsto enhance its competitiveness in the luxury fashion market:

1. Product Quality and Design Innovation

✅Why it’s important?

High fashion brands compete onpremium materials, craftsmanship, and exclusivity.

Quality affectsbrand reputation, pricing strategy, and customer loyalty.

💡Example:XYZ can benchmark againstGucci or Chanelby comparing fabric sourcing, production techniques, and unique design elements.

2. Supply Chain Efficiency and Lead Times

✅Why it’s important?

Speed-to-market iscritical in high fashion, especially for seasonal collections.

Efficient supply chains reduce costs and enhanceinventory management.

💡Example:Zara benchmarks against luxury brandsto optimize supply chains while maintaining affordability.

📌Key Metrics to Benchmark:

Supplier lead times (raw materials to finished goods).

Production cycle time (design to retail store).

Logistics and distribution efficiency.

3. Brand Positioning and Market Perception

✅Why it’s important?

A high fashion brand’s success depends onprestige, exclusivity, and perceived value.

Benchmarking against top competitors helps XYZ maintaina premium brand image.

💡Example:XYZ can compare itsmarketing strategies, social media presence, and celebrity endorsementswithLouis Vuitton or Dior.

📌Key Metrics to Benchmark:

Brand awareness and perception (customer surveys).

Pricing strategy compared to competitors.

Effectiveness of marketing campaigns and influencer collaborations.

4. Sustainability and Ethical Sourcing

✅Why it’s important?

Consumers expecteco-friendly, ethically produced fashion.

Sustainable brands gain a competitive edgeand attract Gen Z and millennial buyers.

💡Example:Stella McCartney’s ethical fashion modelis a benchmark forsustainable materials and responsible sourcing.

📌Key Metrics to Benchmark:

Use of sustainable materials (organic, recycled fabrics).

Ethical supplier compliance withfair labor practices.

Carbon footprint reduction in production and logistics.

5. Customer Engagement and Experience

✅Why it’s important?

Luxury brands thrive onpersonalized customer experiences and loyalty programs.

Omnichannel retail(physical stores + digital platforms) enhances sales and retention.

💡Example:Burberry’s digital transformationprovides a seamlessluxury online shopping experience.

📌Key Metrics to Benchmark:

Online vs. in-store customer engagement levels.

AI-driven personalization in e-commerce.

Customer service responsiveness and return policies.

2. Proposed Strategy for Completing the Benchmarking Exercise

To complete the benchmarking process successfully, XYZ should follow astructured benchmarking approachusing the5-step process:

Step 1: Identify Benchmarking Objectives

🔹Define what XYZ wants to achieve (e.g.,reducing lead times, improving sustainability).🔹Selectbenchmarking partners(competitors, industry leaders, cross-industry comparisons).

Step 2: Data Collection & Research

🔹Useprimary and secondary researchto gather data:

Primary Research:Surveys, interviews, supplier audits.

Secondary Research:Competitor reports, industry data, fashion indexes.

💡Example:Studyingannual sustainability reports from high fashion brandsto benchmark against sustainability best practices.

Step 3: Analyze Performance Gaps

🔹Compare XYZ’scurrent performance metricswith industry benchmarks.🔹Identifygaps and improvement opportunities(e.g., faster supply chain, better brandmarketing).

📌Example Analysis:

XYZ’ssupply chain lead time = 60 daysvs.benchmark brand = 30 days→ Strategy needed for optimization.

Step 4: Develop and Implement Improvement Strategies

🔹SetSMART objectives(Specific, Measurable, Achievable, Relevant, Time-bound).🔹Adjustsupply chain processes, brand positioning, marketing strategies, and customer experience initiatives.

📌Example Action Plan:

Supply Chain:Partner withlocal European suppliersto reduce lead times.

Sustainability:Introduceorganic cotton & cruelty-free leatherin the next collection.

Step 5: Continuous Monitoring and Review

🔹Regularly review benchmarking outcomes.🔹Adjust strategies to remain competitive in the evolving high fashion market.

💡Example:Chanel adapts marketing campaignsevery season to maintain exclusivity and desirability.

Conclusion

Benchmarking allows XYZ to measureproduct quality, supply chain efficiency, brand positioning, sustainability, and customer engagementagainsthigh fashion industry leaders. A structured5-step benchmarking processensures that XYZ continuously improves itsstrategic performance and maintains a competitive edge.