P2 Exam Dumps - Advanced Management Accounting

Three years ago the large number of faulty products being returned by its customers resulted in a company adopting total quality management (TQM). The company has increased expenditure on staff training and product inspections. This has resulted in a reduction in the number of faulty products returned.

Which of the following statements is correct?

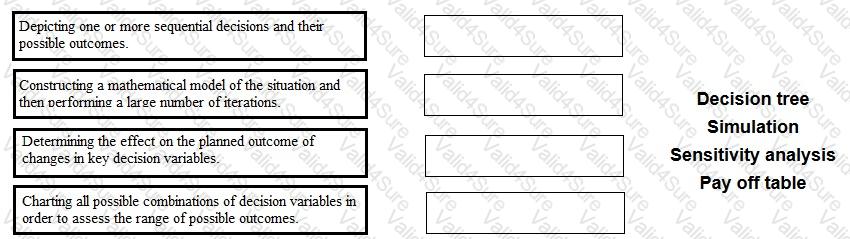

Place each method of analysing risk and uncertainty against the statement that describes it correctly.

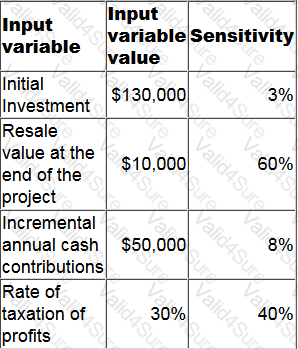

A project is viable because it has a positive net present value (NPV).

Details of four of the input variables, together with the sensitivity of the viability of the project to a change in each one in isolation, are given below.

Which of the following statements is correct?

A project requires an initial investment of $50,000. It will generate positive cash flows for two years as follows.

The cost of capital is 12% per year.

What is the equivalent annual net present value of the project?

Give your answer to the nearest $10.

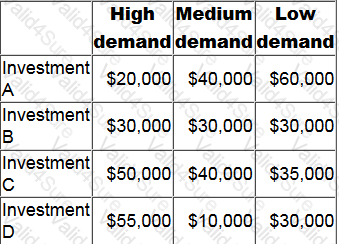

A company is considering four mutually exclusive projects. There are three possible future demand conditions but the company has no idea of the probability of each of these demand conditions occurring. The forecast net present values (NPVs) of each of the four projects, under each of the three possible future demand conditions, are as follows.

Using the maximax criterion, which investment should be selected?

A company comprises several divisions.

One of these divisions was originally expected to earn an operating profit next year of $800,000 on net assets of $4 million.

However, the divisional manager is considering investing in a project that would generate a project return on investment (ROI) of 38% on additional net assets of $500,000.

What would be the divisional ROI next year if the project was implemented?

Give your answer to the nearest percentage.

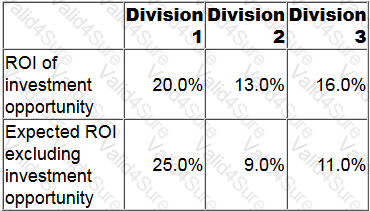

A company has three divisions, each of which is an investment centre. The divisional managers' performance is assessed using return on investment (ROI). A higher ROI will result in a higher bonus for the divisional manager.

The company's cost of capital is 15%.

For the forthcoming year each divisional manager has one investment opportunity available as follows:

The manager(s) of which division(s) will proceed with their respective investment opportunity?

Which of the following statements about the use of traditional budgeting compared with a beyond budgeting approach is correct?