P1 Exam Dumps - Management Accounting

QR uses an activity based budgeting (ABB) system to budget product costs. It manufactures two products, product Q and product R. The budget details for these two products for the forthcoming period are as follows:

The total budgeted cost of setting up the machines is $74,400.

Select TWO potential benefits of using an activity based budgeting system.

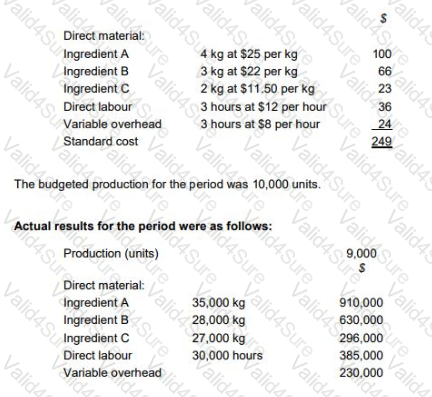

TP makes wedding cakes that are sold to specialist retail outlets which decorate the cakes according to the customers’ specific requirements. The standard cost per unit of its most popular cake is as follows:

The general market prices at the time of purchase for Ingredient A and Ingredient B were $23 per kg and $20 per kg respectively. TP operates a JIT purchasing system for ingredients and a JIT production system; therefore, there was no inventory during the period.

What was the material price planning variance for ingredient B?

An ice cream manufacturer experiences regular fluctuations in sales.

Which component in a time series do these fluctuations represent?

In a manufacturing company, breakeven occurs at which TWO of the following?

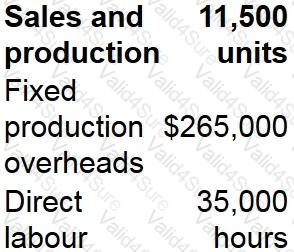

A company's product has the following standard selling price, variable costs and contribution:

Budgeted sales and production was 20,000 units and actual was 19,500 units.

Due to a market downturn the production and sales budget should have been 10% lower.

What is the operational sales volume contribution variance?

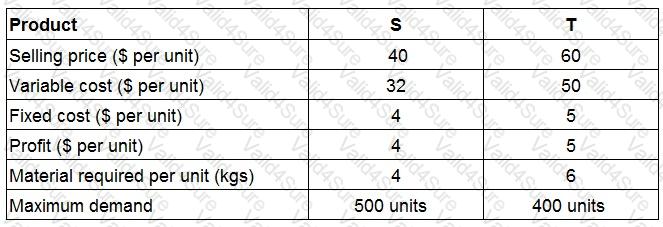

Two products being produced by a company require the same material which is limited to 2,600 kgs.

What is the optimal production plan?

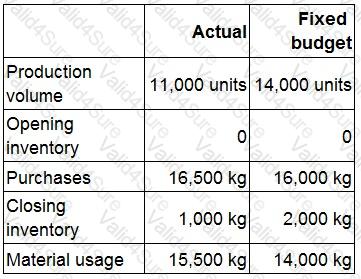

Budgeted sales and production for Product X for this period are 12,000 units.

The standard cost and selling price for a single unit of the product are:

The fixed production overhead expenditure variance is:

A manufacturing company has more units of finished goods inventory at the end of a period than at the beginning of the period.

Which of the following statements is true?