P1 Exam Dumps - Management Accounting

Searching for workable clues to ace the CIMA P1 Exam? You’re on the right place! ExamCert has realistic, trusted and authentic exam prep tools to help you achieve your desired credential. ExamCert’s P1 PDF Study Guide, Testing Engine and Exam Dumps follow a reliable exam preparation strategy, providing you the most relevant and updated study material that is crafted in an easy to learn format of questions and answers. ExamCert’s study tools aim at simplifying all complex and confusing concepts of the exam and introduce you to the real exam scenario and practice it with the help of its testing engine and real exam dumps

A manufacturing company has a capacity of 10,000 units. The flexed production cost budget of the company is as follows:

All costs are either fixed, variable or semi-variable.

What is the budgeted total production cost if the company operates at 85% capacity?

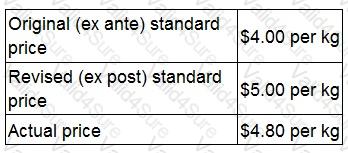

A company reports planning and operational variances to its managers. The following data are available concerning the price of direct material M in the last period. Material M is the only material used by the company. The company operates a just-in-time (JIT) purchasing system.

Which TWO of the following statements about last period are definitely correct based on this information?

The direct material price operational variance was adverse.

A company operates a customer complaints department.

How will the cost of the customer complaints department be classified in a system focussed on quality related costs?

A company sells and services photocopying machines. Its sales department sells the machines and consumables, including ink and paper, and its service department provides an after sales service to its customers. The after sales service includes planned maintenance of the machine and repairs in the event of a machine breakdown. Service department customers are charged an amount per copy that differs depending on the size of the machine.

The company’s existing costing system uses a single overhead rate, based on total sales revenue from copy charges, to charge the cost of the Service Department’s support activities to each size of machine. The Service Manager has suggested that the copy charge should more accurately reflect the costs involved. The company’s accountant has decided to implement an activity-based costing system and has obtained the following information about the support activities of the service department:

Calculate the annual profit per machine for each of the three sizes of machine using activity-based costing.

RT produces two products from different quantities of the same resources using a just-in-time (JIT) production system. The selling price and resource requirements of each of the products are shown below:Â

Market research shows that the maximum demand for products R and T during June 2010 is 500 units and 800 units respectively. This does not include an order that RT has agreed with a commercial customer for the supply of 250 units of R and 350 units of T at selling prices of $100 and $135 per unit respectively. Although the customer will accept part of the order, failure by RT to deliver the order in full by the end of June will cause RT to incur a $10,000 financial penalty. At a recent meeting of the purchasing and production managers to discuss the production plans of RT for June, the following resource restrictions for June were identified: Direct labour hours 7,500 hoursÂ

Material A 8,500 kgs

Material B 3,000 litres

Machine hours 7,500 hours

Assuming that RT completes the order with the commercial customer, prepare calculations to show, from a financial perspective, the optimum production plan for June 2010 and the contribution that would result from adopting this plan.Â

The contribution per unit for R and T will be...?

A company manufactures two products and has two production constraints.

When the graphical approach to linear programming is used, the axes of the graph will show:

A company produces and sells two products, product A and product B.

What are the total fixed costs when the weighted average contribution per unit is $5 and the breakeven points for product A and product B are 10,000 units and 5,000 units respectively?

Give your answer as a whole number (in 000's).

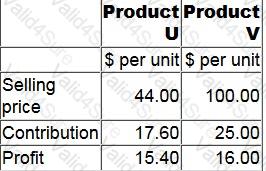

Information about a company's only two products is as follows:

The revenue from the products must be in the constant mix of 2U:3V. Budgeted monthly sales revenue is $110,000.

Fixed costs are $23,095 each month.

To the nearest $10, what is the budgeted monthly margin of safety in terms of sales revenue?