BA2 Exam Dumps - Fundamentals of management accounting

Searching for workable clues to ace the CIMA BA2 Exam? You’re on the right place! ExamCert has realistic, trusted and authentic exam prep tools to help you achieve your desired credential. ExamCert’s BA2 PDF Study Guide, Testing Engine and Exam Dumps follow a reliable exam preparation strategy, providing you the most relevant and updated study material that is crafted in an easy to learn format of questions and answers. ExamCert’s study tools aim at simplifying all complex and confusing concepts of the exam and introduce you to the real exam scenario and practice it with the help of its testing engine and real exam dumps

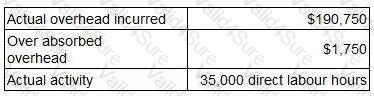

A company absorbs production overhead using a direct labour hour rate. Data for the latest period are as follows:

What is the overhead absorption rate per direct labour hour? Give your answer to one decimal place.

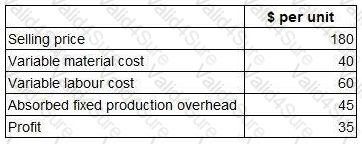

A company makes and sells a range of products. The standard details per unit for one of these products, product X, are as follows.

To meet sales demand, the company must obtain 2,000 units of product X next month. There is sufficient labour capacity to produce 1,500 of these units in-house during normal time. However, any production above this level would require overtime working which would be paid at a premium of 50%.

The company can buy as many units of product X as it wishes next month from an external supplier at a price of $120 per unit.

What is the total financial benefit to the company of purchasing the appropriate number of units from the external supplier rather than producing them in-house?

Refer to the exhibit.

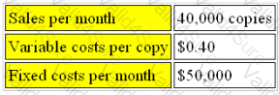

ZAP publishes a monthly magazine aimed at the teenage market. It has drawn up a budget for next year as follows:

The magazine is currently sold at $2.00 per copy.

The margin of safety is

It is company policy that the closing inventory of finished goods must be equal to 20% of the following month's budgeted sales. The budget sales for November and December are 6,000 and 7,000 units respectively.

The budgeted production for November will be

A company uses an integrated accounting system and absorbs production overhead using a predetermined rate of $6 per machine hour.

Last period a total of 25,500 machine hours were worked and the actual production overhead incurred was $158,000.

The accounting entries for the absorption of production overhead for the period would be:

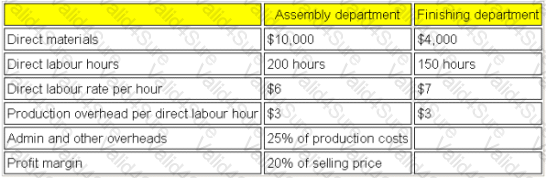

Refer to the exhibit.

The following information relates to Job 123:

The selling price to the customer for Job 123 is:

Refer to the exhibit.

SP, a manufacturing company, uses a standard costing system. The standard variable production overhead cost is based on the following budgeted figures for the year:

During the month of September, 5,300 actual hours were worked and 5,600 standard hours of output were produced. Total variable production overhead costs in September were $8,600.

What was the variable production overhead expenditure variance in September?