BA2 Exam Dumps - Fundamentals of management accounting

The wages of a machine operator who is paid a guaranteed minimum wage plus a bonus for each unit produced would be described as A.

In a manufacturing company which produces a range of products, the production manager's salary would be classified as A.

FL uses an absorption costing system. The overhead absorption rate for production overheads is $8.60 per direct labour hour.

Budgeted production overhead costs for the year were $473,000 and actual costs incurred were $468,000. 56,000 labour hours were used.

Which ONE of the following statements is correct?

GB Limited operates a standard costing system. During the month 18,500 labour hours were worked at a standard cost of $6 per hour. The labour efficiency variance was $8,700 favourable.

How many standard hours were produced?

Which of the following statements relating to risk and uncertainty is correct?

In a company that manufactures many different products on the same production line, which TWO of the following would NOT be classified as indirect production costs? (Choose two.)

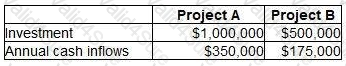

A company is appraising two projects. Both projects are for five years. Details of the two projects are as follows.

Based on the above information, which of the following statements is correct?