BA2 Exam Dumps - Fundamentals of management accounting

Searching for workable clues to ace the CIMA BA2 Exam? You’re on the right place! ExamCert has realistic, trusted and authentic exam prep tools to help you achieve your desired credential. ExamCert’s BA2 PDF Study Guide, Testing Engine and Exam Dumps follow a reliable exam preparation strategy, providing you the most relevant and updated study material that is crafted in an easy to learn format of questions and answers. ExamCert’s study tools aim at simplifying all complex and confusing concepts of the exam and introduce you to the real exam scenario and practice it with the help of its testing engine and real exam dumps

Refer to the exhibit.

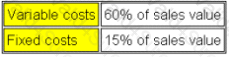

BF plc manufactures and sells a single product. Budgeted figures for next year are as follows:

BF plc is considering increasing its selling price by 5%. It is anticipated that fixed costs, variable costs per unit and sales volume will remain unchanged.

What would be the effect on BF plc's contribution if selling prices are increased?

Refer to the exhibit.

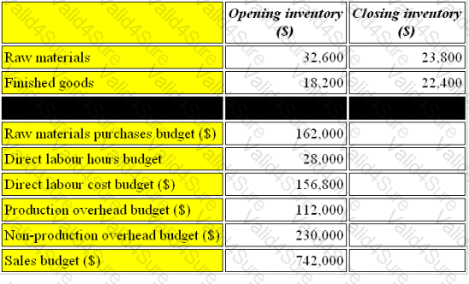

A company has the following budget information for next year:

The budgeted profit for the year is

An organisation produces and sells a single product. The organisation’s management accountant has reported the following information for the most recent period.

Which TWO of the following statements are valid? (Choose two.)

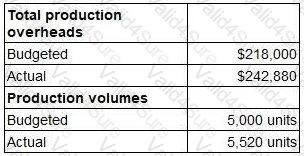

A company uses an integrated accounting system. The following data relate to the latest period.

At the end of the period, the entry in the production overhead control account in respect of under or over absorbed overheads will be:

A company’s management accountant wishes to calculate the present value of the cost of renting a delivery vehicle. There will be five annual rental payments of $5,000, the first of which is due immediately. The company’s discount rate is 12%.

Which TWO of the following are valid ways to calculate the present value of the rental payments? (Choose two.)

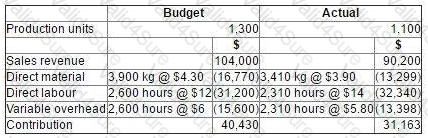

Data for the latest period for a company which makes and sells a single product are as follows:

There were no budgeted or actual changes in inventories during the period.

The sales volume contribution variance for the period was:

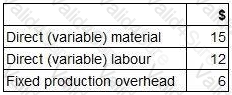

The forecast costs per unit for a new product are as follows:

The company uses marginal cost plus pricing and all products are required to achieve a 40% margin.

What would be the selling price per unit?

Which of the following is NOT a characteristic of useful operational level information?