BA2 Exam Dumps - Fundamentals of management accounting

Searching for workable clues to ace the CIMA BA2 Exam? You’re on the right place! ExamCert has realistic, trusted and authentic exam prep tools to help you achieve your desired credential. ExamCert’s BA2 PDF Study Guide, Testing Engine and Exam Dumps follow a reliable exam preparation strategy, providing you the most relevant and updated study material that is crafted in an easy to learn format of questions and answers. ExamCert’s study tools aim at simplifying all complex and confusing concepts of the exam and introduce you to the real exam scenario and practice it with the help of its testing engine and real exam dumps

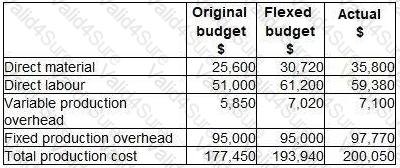

The following is an extract from a budgetary control report for the latest period:

The budget variance for prime cost is:

The year-to-date results at the end of month 9 included sales revenue of $3,600,000 and variable costs of $2,100,000.

During month 10, sales revenue was $450,000 and variable costs were $270,000.

What year-to-date contribution to sales ratio (C/S ratio) would be reported at the end of month 10?

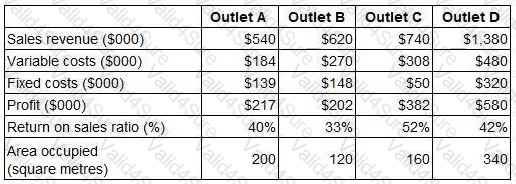

A small airport’s management accountant has prepared the following management report on the performance of its four retail outlets.

Which retail outlet has the highest contribution per square metre?

Which THREE of the following are parts of the master budget? (Choose three.)

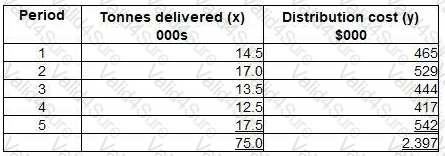

The following data are available for a delivery company. The table shows the number of tonnes delivered (x) and the associated distribution cist (y) in recent periods.

Further analysis of this data has determined the following:

∑xy = 36,427∑x2 = 1,144

Using least squares regression analysis, calculate the variable cost per tonne delivered. Give your answer to the nearest cent.

A project is about to be launched. Two of the three possible outcomes and their associated probabilities are as follows:

The remaining possible outcome is a $70,000 gain.

What is the correct calculation of the expected value of the project?

The production manager of your company has asked you to explain the methods of overhead analysis used, in particular the meaning of reciprocal servicing.

Reciprocal servicing is:

When sales and output have passed the break-even point, the contribution per unit, for each unit then sold, becomes: