BA2 Exam Dumps - Fundamentals of management accounting

Searching for workable clues to ace the CIMA BA2 Exam? You’re on the right place! ExamCert has realistic, trusted and authentic exam prep tools to help you achieve your desired credential. ExamCert’s BA2 PDF Study Guide, Testing Engine and Exam Dumps follow a reliable exam preparation strategy, providing you the most relevant and updated study material that is crafted in an easy to learn format of questions and answers. ExamCert’s study tools aim at simplifying all complex and confusing concepts of the exam and introduce you to the real exam scenario and practice it with the help of its testing engine and real exam dumps

A company achieves a profit/volume ratio of 25%. Sales for the month of July were £127,280 and fixed costs were £24,872.

What was the profit for the month?

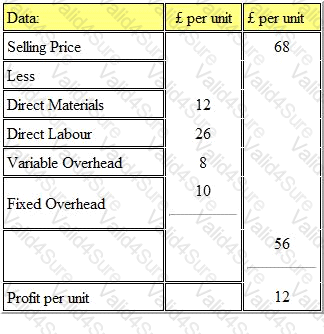

Refer to the exhibit.

A company manufactures and sells a single product which has the following cost and selling price structure:

The fixed overhead absorption rate was based on normal capacity of 1800 units per month.

The budgeted break-even point in sales units per month is units.

Xter Ltd produces product 'PZ'. The forecast sales for the forthcoming year are 50,000 units.

It is anticipated that there will be 10,000 units of opening inventory at the beginning of the year. However, management wishes to reduce this inventory by 30% by the end of next year.

The production budget for the forthcoming year will be

VL manufactures a single product. The management accountant has estimated that the margin of safety as a percentage of budgeted sales is 25%. The company's profit/volume ratio is 20%, variable costs are $8 per unit and budgeted sales for the year are 80,000 units.

The budgeted fixed costs for the year, to the nearest $000, are.