CBAP Exam Dumps - Certified Business Analysis Professional

Company A is a nation-wide leader in commercial demolition. Having just celebrated its 100th year of operations, the company decided to begin doing work internationally. The current system used for reporting company finances is unable to keep pace with the potential demands of doing work in geographically dispersed locations. Therefore, the company decided to replace its client-based Profit & Loss (P&L) reporting system with a more robust, web-based system. This will ensure transparency across the organization and enable better decision making.

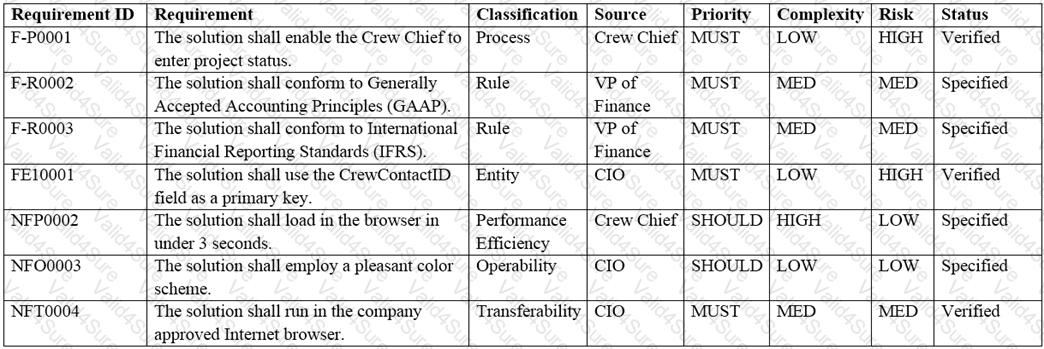

The business analyst (BA) at Company A has recently completed several rounds of elicitation to determine the requirements for the new, web-based system. Over 1250 requirements were elicited. An initial Requirements Traceability Matrix (RTM) has been drafted, and a subset of the RTM can be seen below:

While verifying the requirements, the BA notices that Requirement ID NFO0003 does not meet the "unambiguous" or the "testable" characteristics of requirements quality. The BA plans to re-write the requirement.

Which of the following requirements is both unambiguous and testable?

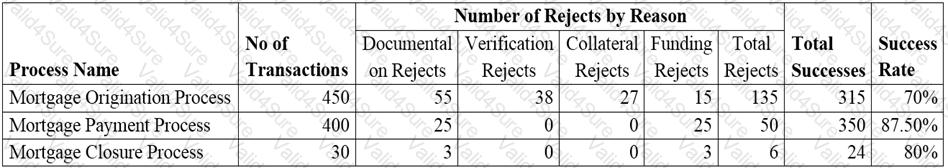

A financial institution engaged in mortgage lending has embarked on a business process improvement initiative to eliminate the activities that hinder growth to ultimately improve the success rate of its mortgage business. As a benchmark for identification, the institution is keen on improving any business process that has less than a 75% success rate. The institution has appointed a business analyst (BA) to review the business transactions for the processes of origination, payments, and closures, as well as identify opportunities for improvements and recommend solutions.

The BA has collected the following information over the last three months pertaining to these business processes:

•All the business processes are at their maximum capacity in terms of the current number of transactions.

•Each business process has a certain number of rejects and the reasons for rejection include documentation, verification, collateral, and funding. Funding rejects occur when the bank's customers have failed to make payment of their mortgage processing fee or mortgage closure payment.

The BA has also recommended the use of documentation checklists as a solution to eliminate the documentation rejects.

If the financial institution always works at full capacity month to month and the new success rate continues to remain the same after implementing the BA's recommendation, what is the average number of successes per month for the mortgage closure process, if the current process capability were increased by 50%?

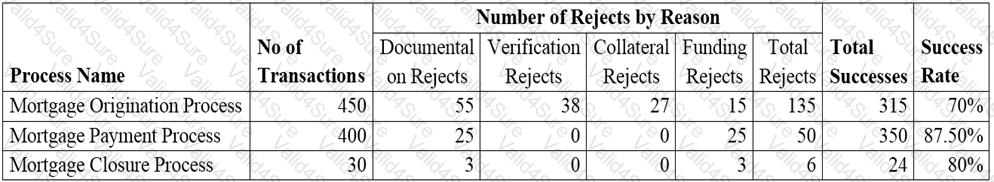

A financial institution engaged in mortgage lending has embarked on a business process improvement initiative to eliminate the activities that hinder growth to ultimately improve the success rate of its mortgage business. As a benchmark for identification, the institution is keen on improving any business process that has less than a 75% success rate. The institution has appointed a business analyst (BA) to review the business transactions for the processes of origination, payments, and closures, as well as identify opportunities for improvements and recommend solutions.

The BA has collected the following information over the last three months pertaining to these business processes:

•All the business processes are at their maximum capacity in terms of the current number of transactions.

•Each business process has a certain number of rejects and the reasons for rejection include documentation, verification, collateral, and funding. Funding rejects occur when the bank's customers have failed to make payment of their mortgage processing fee or mortgage closure payment.

The BA has also recommended the use of documentation checklists as a solution to eliminate the documentation rejects.

If an additional recommendation to reduce Verification Rejects by 50% were to be introduced into the mortgage origination process, what is the potential success rate of the mortgage origination process?

A business analyst (BA) is reviewing the performance results from a recent change initiative. One of the results stated, "The planned schedule expected 50% of the project to be done at milestone 6. The schedule performance index (SPI) was .87. Three project team members worked overtime to ensure that the actual schedule would align with the planned schedule."

This is an example of what type of action?

A company with a big information technology (IT) department has hired a lead business analyst (BA) to enhance its business analysis practices. The lead BA discovers that sponsors are not satisfied with project outcomes. Developers complain about incomplete, ambiguous, and changing requirements. All stakeholders, including project managers, are blaming long cycles of analysis for the delays. The business analysts, in turn, feel overwhelmed with the number of projects and frustrated by the lack of collaboration from reviewers of their deliverables. All of the evidence is anecdotal and none of the groups could strongly substantiate their opinions.

Even after dozens of reviews, some stakeholders refuse to sign off on the requirements specification documents because of a few questionable requirements. This puts the projects at risk and creates tension between the participants. What should the lead BA do first?

A business analyst (BA) has just completed a number of elicitation activities and is preparing to review the stated requirements. As part of this, the BA is checking the compliance of the stated requirements with organizational standards for business analysis.

What state is the BA attempting to move the requirements into?

A software development company is in the process of creating a new product for their customer base. It has been several years since such a project has been initiated and the organization has created a new team to own and develop the product. The project team will be evaluated by the successful adoption of the product, which will be developed over the next 12 months.

The team's business analyst (BA) has analyzed the current state in partnership with the product owner and

has been meeting with senior management to identify the goals that need to be attained. A broad view of the business has been analyzed in order to have an understanding of how the company is currently providing value to its customer base.

What has the BA been identifying that will be used to evaluate the solution?

You are the business analyst for your organization. Management has asked that you create a method to store the project requirements including those under development, under review, and the requirements which have been approved.

What is management asking you to create?