CCP Exam Dumps - Certified Cost Professional (CCP) Exam

The following question requires your selection of CCC/CCE Scenario 28 (3.7.50.1.7) from the right side of your split screen, using the drop down menu, to reference during your response/choice of responses.

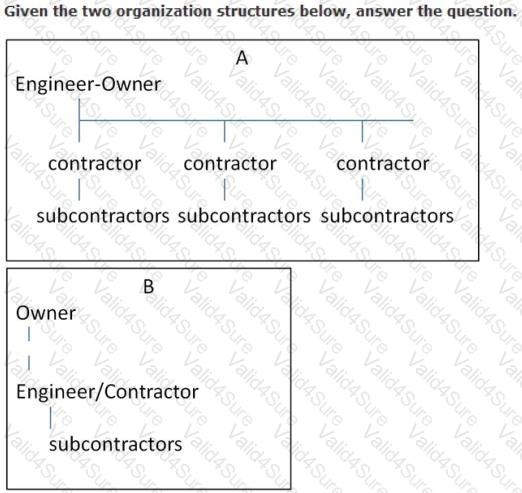

In the A relationship, the subcontractor might use an unbalance bid to:

The following question requires your selection of CCC/CCE Scenario 2 (2.3.50.1.2) from the right side of your split screen, using the drop down menu, to reference during your response/choice of responses.

9,375 hours have been expended to date. Planned completion at this time is 75%. The project is determined to be 66% complete. What is the current schedule performance index (SPI)?

After collecting the control information on a light rail project within an original budget of 200.000 work hours, the construction contractor is ready for their monthly progress meeting with the client.

A total of 100.000 work hours have boon scheduled to date. with 105.000 work hours earned, and 110.000 work hours paid. The stated progress by the contractor Is 60%.

What is a method for figuring estimate at completion (EAC)?

An agricultural corporation that paid 53% in income tax wanted to build a grain elevator designed to last twenty-five (25) years at a cost of $80,000 with no salvage value. Annual income generated would be $22,500 and annual expenditures were to be $12,000.

Answer the question using a straight line depreciation and a 10% interest rate.

If $50 was invested at 6.0% on January 1, year 1, what would be the value of year-end withdrawals made in equal amounts each year for 10 years and leaving nothing in the fund after the tenth withdrawal?

If a project is said to be on a "fast track program/' the fast track method is:

Money is value. Having money when you need it is very important. Money can also be valuable when used wisely by knowing when to spend and when to conserve Also, planning now for future expenses can be a plus to the company rather than a debit.

There are several ways to capitalize money and spending. Basically there is the single payment method that has a compound amount factor and a present worth factor. There is the uniform annual series that has a sinking fund factor, capital recovery factor and also the compound amount factor and present worth factor. At this point, we can assure money is worth 10%.

The following question requires your selection of CCC/CCE Scenario 7 (4.8.50.1.1) from the right side of your split screen, using the drop down menu, to reference during your response/choice of responses.

If $20,000 is invested at the end of each fiscal year for the next 10 years, how much would our total investment be worth assuming the interest is at 10%?

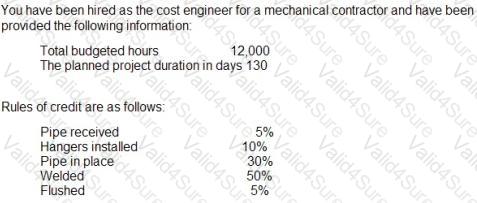

The following question requires your selection of Scenario 1.4.150 from the right side of your split screen, using the drop down menu, to reference during your response/choice of responses.

Annual depreciation (in USS) would be calculated as follows for a capital recovery with salvage analysis:

An agricultural corporation that paid 53% in income tax wanted to build a grain elevator designed to last twenty-five (25) years at a cost of $80,000 with no salvage value. Annual income generated would be $22,500 and annual expenditures were to be $12,000.

Answer the question using a straight line depreciation and a 10% interest rate.

If you buy a lot for $3,000 and sell it for $6,000 at the end of 8 years, what is your annual rate of return?