CCP Exam Dumps - Certified Cost Professional (CCP) Exam

After collecting the control information on a light rail project within an original budget of 200.000 work hours, the construction contractor is ready for their monthly progress meeting with the client.

A total of 100.000 work hours have boon scheduled to date. with 105.000 work hours earned, and 110.000 work hours paid. The stated progress by the contractor Is 60%.

What is the cost performance index (CPI)?

If you deposit $100 per month for two (2) years and earn interest at 12% APR (Annual Percentage Rate) compounded monthly, how much will you have at the end of the period?

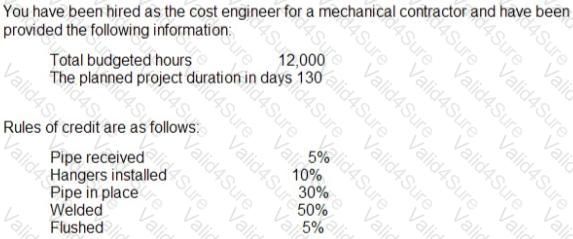

The following question requires your selection of CCC/CCE Scenario 2 (2.3.50.1.2) from the right side of your split screen, using the drop down menu, to reference during your response/choice of responses.

10,278 hours have been expended to date. The CPI at this point in time is 0.93. SPI is 1.03. How many hours have been earned?

A major theme park is expanding the existing facility over a five-year period. The design phase will be completed one year after the contract is awarded. Major engineering drawings will be finalized two years after the design contract is awarded and construction will begin three years after the award of the design contract. New, unique ride technology will be used and an estimate will need to be developed to identify these costs that have no historical data.

Fred Fiedler's contingency model suggests that:

A major theme park is expanding the existing facility over a five-year period. The design phase will be completed one year after the contract is awarded. Major engineering drawings will be finalized two years after the design contract is awarded and construction will begin three years after the award of thedesign contract. New, unique ride technology will be used and an estimate will need to be developed to identify these costs that have no historical data.

Which of the following percent complete measurement techniques is best suited for long-term non-production accounts (such as overhead accounts)?

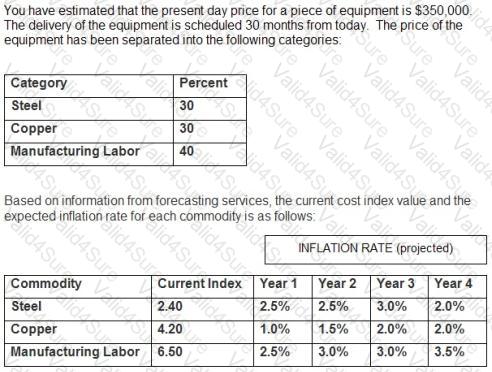

The following question requires your selection of CCC/CCE Scenario 4 (2.7.50.1.1) from the right side of your split screen, using the drop down menu, to reference during your response/choice of responses.

What is the cost of manufacturing labor for the piece of equipment today?

Which of the following is NOT an advantage specific to a cost reimbursable contract?

An agricultural corporation that paid 53% in income tax wanted to build a grain elevator designed to last twenty-five (25) years at a cost of $80,000 with no salvage value. Annual income generated would be $22,500 and annual expenditures were to be $12,000.

Answer the question using a straight line depreciation and a 10% interest rate.

The following question requires your selection of CCC/CCE Scenario 17 (4.2.50.1.1) from the right side of your split screen, using the drop down menu, to reference during your response/choice of responses.

What is the "book value (BV) of the asset at the end of 5 years?