CCP Exam Dumps - Certified Cost Professional (CCP) Exam

A major theme park is expanding the existing facility over a five-year period. The design phase will be completed one year after the contract is awarded. Major engineering drawings will be finalized two years after the design contract is awarded and construction will begin three years after the award of the design contract. New, unique ride technology will be used and an estimate will need to be developed to identify these costs that have no historical data.

Which of the following methods a used for creating critical path schedules:

When a person hears the words being said to him/her, but does not receive the message of the words, it is called

A major theme park is expanding the existing facility over a five-year period. The design phase will be completed one year after the contract is awarded. Major engineering drawings will be finalized two years after the design contract is awarded and construction will begin three years after the award of the design contract. New, unique ride technology will be used and an estimate will need to be developed to identify these costs that have no historical data.

The following question requires your selection of CCC/CCE Scenario 26 (2.5.50.1.2) from the right side of your split screen, using the drop down menu, to reference during your response/choice of responses.

What class of estimate is used for the preliminary design phase of a project?

The following question requires your selection of CCC/CCE Scenario 28 (3.7.50.1.7) from the right side of your split screen, using the drop down menu, to reference during your response/choice of responses.

An unbalanced bid methodology can best be used by:

The following question requires your selection of CCC/CCE Scenario 28 (3.7.50.1.7) from the right side of your split screen, using the drop down menu, to reference during your response/choice of responses.

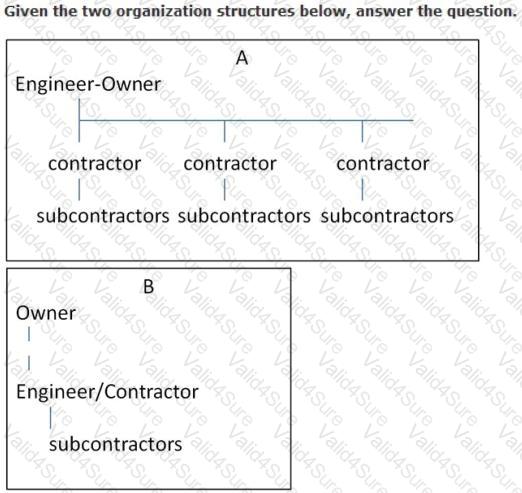

If the owner in A has a primary goal of completion within budget, the following contract types with the engineer/contractor would be best:

The following question requires your selection of CCC/CCE Scenario 6 (2.7.50.1.3) from the right side of your split screen., using the drop down menu, to reference during your response/choice of responses.

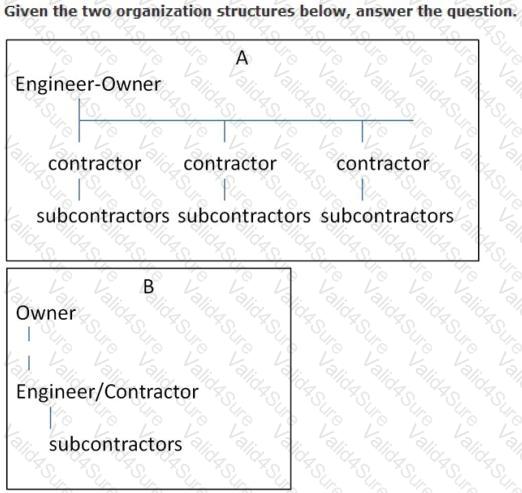

Calculate the weighted average unit cost.

A used concrete pumping truck can be purchased for $125,000. The operation costs are expected to be $65,000 the first year and increase 5% each year thereafter. As a result of the purchase, the company will see an increase in income of $100,000 the first year and 5% more each subsequent year. The company uses straight-line depreciation. The truck will have a useful life of five (5) years and no salvage value. Management would like to see a 10% return on any investment. The company's tax rate is 28%.

The return on investment at the end of the fifth year would be:

A used concrete pumping truck can be purchased for $125,000. The operation costs are expected to be $65,000 the first year and increase 5% each year thereafter. As a result of the purchase, the company will see an increase in income of $100,000 the first year and 5% more each subsequent year. The company uses straight-line depreciation. The truck will have a useful life of five (5) years and no salvage value. Management would like to see a 10% return on any investment. The company's tax rate is 28%.

Costs which are independent of the system throughout are: