CCP Exam Dumps - Certified Cost Professional (CCP) Exam

Searching for workable clues to ace the AACE International CCP Exam? You’re on the right place! ExamCert has realistic, trusted and authentic exam prep tools to help you achieve your desired credential. ExamCert’s CCP PDF Study Guide, Testing Engine and Exam Dumps follow a reliable exam preparation strategy, providing you the most relevant and updated study material that is crafted in an easy to learn format of questions and answers. ExamCert’s study tools aim at simplifying all complex and confusing concepts of the exam and introduce you to the real exam scenario and practice it with the help of its testing engine and real exam dumps

A major theme park is expanding the existing facility over a five-year period. The design phase will be completed one year after the contract is awarded. Major engineering drawings will be finalized two years after the design contract is awarded and construction will begin three years after the award of the design contract. New, unique ride technology will be used and an estimate will need to be developed to identify these costs that have no historical data.

Profits that could not be formally recognized during a specific financial accounting period because the goods and services did not satisfy all the customer's requirements are:

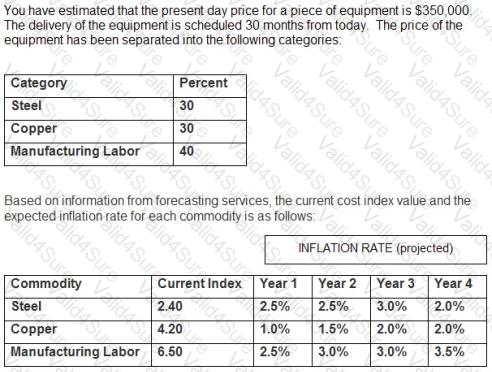

The following question requires your selection of CCC/CCE Scenario 4 (2.7.50.1.1) from the right side of your split screen, using the drop down menu, to reference during your response/choice of responses.

At the end of 30 months, copper prices will have increased by what percentage over today's price?

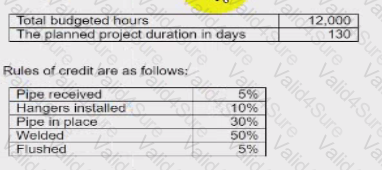

You have been hired as the cost engineer for a mechanical contractor and have been provided the following information:

What is the schedule performance index (SPI)?

An owner advertised his villa for sale. An investor worked out an estimate on the basis mat the villa could be rented out for $1000 per month. Maintenance charges and other taxes are estimated to be $1,500 per year. The tenant has to pay all utility charges. The investor thinks that he can sell this villa for S100.000 alter 6 years. Assuming that the minimum acceptable rate of return is 12%. answer the following question.

The villa could be recommended for purchase at all of the below-mentioned prices except:

A used concrete pumping truck can be purchased for $125,000. The operation costs are expected to be $65,000 the first year and increase 5% each year thereafter. As a result of the purchase, the company will see an increase in income of $100,000 the first year and 5% more each subsequent year. The company uses straight-line depreciation. The truck will have a useful life of five (5) years and no salvage value. Management would like to see a 10% return on any investment. The company's tax rate is 28%.

What Kind of optimization modeling is used in making investment analysis to evaluate the risks associated with the potential investment?

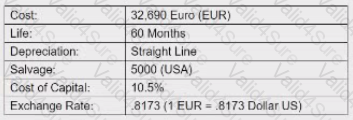

An American company plans to acquire a new press machine from a Dutch manufacturer under the following conditions. One question remaining to be answered is the expected amount of capital recovery when salvage is accounted for.

The equivalent value of an investment alternative in today's dollars is referred to as the:

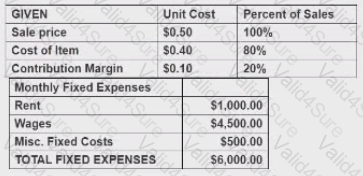

As the leas cost engineer for the XYZ Services Company, you have been requested to provide pertinent for an equipment rental decision. The unit price of the food stuffs varies, but an average unit selling process has been determined to be $0.50 cents and the average unit acquisition cost is $0.40 cents.

The following revenue and expense relationships are predicted:

If XYZ considers S550 per month the minimum acceptable net income, the number of units that will have to be sold is: