CCP Exam Dumps - Certified Cost Professional (CCP) Exam

Searching for workable clues to ace the AACE International CCP Exam? You’re on the right place! ExamCert has realistic, trusted and authentic exam prep tools to help you achieve your desired credential. ExamCert’s CCP PDF Study Guide, Testing Engine and Exam Dumps follow a reliable exam preparation strategy, providing you the most relevant and updated study material that is crafted in an easy to learn format of questions and answers. ExamCert’s study tools aim at simplifying all complex and confusing concepts of the exam and introduce you to the real exam scenario and practice it with the help of its testing engine and real exam dumps

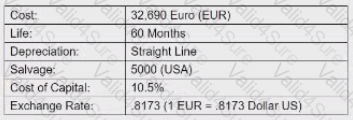

An American company plans to acquire a new press machine from a Dutch manufacturer under the following conditions. One question remaining to be answered is the expected amount of capital recovery when salvage is accounted for.

The following question requires your selection el Scenario 1.4.150 from the right side of your split screen. using the drop down menu to reference during your response/choice of responses.

Based on your analysis, should the press be purchased?

A major theme park is expanding the existing facility over a five-year period. The design phase will be completed one year after the contract is awarded. Major engineering drawings will be finalized two years after the design contract is awarded and construction will begin three years after the award of the design contract. New, unique ride technology will be used and an estimate will need to be developed to identify these costs that have no historical data.

The project scheduler left the company and has left unfinished work. You have been hired as the new project scheduler and must update the existing schedule. What will be your first task?

The following question requires your selection of CCC/CCE Scenario 2 (2.3.50.1.2) from the right side of your split screen, using the drop down menu, to reference during your response/choice of responses.

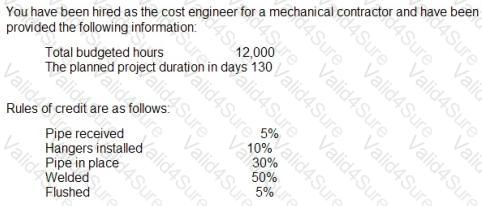

The entire pipe has been received, hangers have been installed, and all pipes are in place. None has been welded or flushed. What percent complete is this project?

The latest allowable end time minus the earliest allowable end time on a schedule activity is referred to as:

SCENARIO: A can manufacturing company requested you to provide data for their decision making The unit prices of the can varies but an average selling price of $0.55 cents and average cost of S45 cents is estimated.

The monthly fixed costs are:

Rant-$1,500

Wages - $4.000

Miscellaneous fixed expenses - $500

If the rent increases by 100% and the unit sales/other costs remain unchanged, the new break even amount is?